vipartstudio.online

Community

Refinance Interest Rates 15 Year Fixed

Free calculator to plan the refinancing of loans by comparing existing and refinanced loans side by side, with options for cash out, mortgage points. Shorter terms. Another reason is to shorten the terms of your mortgage. This could mean moving from a year to a year mortgage, for. The average rate for a year refinance is %, as of December Keep in mind that you'll generally need good to excellent credit, stable income and a. Refinance rates ; yr fixed · % · % ; yr fixed FHA · % · % ; yr fixed · % · % ; yr fixed · % · %. Current Fifteen Year Mortgage Rates Available Locally ; Beeline Loans, Inc. NMLS # · % · $1, /mo · % ; New American Funding, LLC. NMLS # The best 3-year fixed insured mortgage rate is %, which is 15 bps lower than 30 days ago and 5 bps lower than 7 days ago; The best 4-year fixed insured. Explore current RBC mortgage rates, including fixed rates, variable rates, and special offers. A year fixed rate mortgage is a home loan with a repayment period of 15 years. It has an interest rate that does not change throughout the life of the loan. The rule of thumb has been that refinancing is a good idea if you can reduce your interest rate by at least 2%. However, many lenders say 1% savings is enough. Free calculator to plan the refinancing of loans by comparing existing and refinanced loans side by side, with options for cash out, mortgage points. Shorter terms. Another reason is to shorten the terms of your mortgage. This could mean moving from a year to a year mortgage, for. The average rate for a year refinance is %, as of December Keep in mind that you'll generally need good to excellent credit, stable income and a. Refinance rates ; yr fixed · % · % ; yr fixed FHA · % · % ; yr fixed · % · % ; yr fixed · % · %. Current Fifteen Year Mortgage Rates Available Locally ; Beeline Loans, Inc. NMLS # · % · $1, /mo · % ; New American Funding, LLC. NMLS # The best 3-year fixed insured mortgage rate is %, which is 15 bps lower than 30 days ago and 5 bps lower than 7 days ago; The best 4-year fixed insured. Explore current RBC mortgage rates, including fixed rates, variable rates, and special offers. A year fixed rate mortgage is a home loan with a repayment period of 15 years. It has an interest rate that does not change throughout the life of the loan. The rule of thumb has been that refinancing is a good idea if you can reduce your interest rate by at least 2%. However, many lenders say 1% savings is enough.

The national average year fixed refinance interest rate is %, down compared to last week's of %.

With a year fixed rate loan, you'll completely pay off your mortgage in just 15 years. Because your interest rate is locked, your principal and interest. Today's Special Mortgage Rates ; 3 Year Fixed · Amortization · %. % ; 5 Year Smart Fixed · Default insured mortgage · %. % ; 5 Year Smart Fixed. A year fixed mortgage is a type of home loan with a fixed interest rate and a repayment plan spanning 15 years. As a popular option for first-time homebuyers. A year fixed mortgage helps borrowers save on interest and pay off their home loan faster. Looking for a fixed interest rate and a shorter loan term? A. The average APR on a year fixed-rate mortgage rose 6 basis points to % and the average APR for a 5-year adjustable-rate mortgage (ARM) remained at Refinance Rates Today · Term Length Options: · Rate Range: · Year Fixed Rate · % - % APR · Year Fixed Rate · % - % APR · Year Fixed Rate. The year mortgage has some advantages when compared to the year, such as less overall interest paid, a lower interest rate, lower fees, and forced. Introduction to Year Fixed Mortgages ; Jumbo, %, % ; 15 Year Fixed Average, %, % ; Conforming, %, % ; FHA, %, %. What is the current rate for a year, fixed-rate mortgage? Find out what the current year, fixed-rate mortgage rates look like and apply today! Most lenders offer a lower rate for a year refinance. However, even the slightest difference in percentage points can significantly affect the overall cost. If you have a year mortgage at % and can get a year refinance loan at %, refinancing can help you pay off your loan faster. But make sure you can. A year mortgage rate specifically is the annual rate of interest you can expect to pay on a mortgage that lasts 15 years. At the time they refinance, current rates for a year mortgage are at %, while year fixed rates are averaging %. Here's how their refinance options. The average fixed year refinance rate was % in mid-April, remaining below the 7% mark reached in November If you want to lower your mortgage. year refinance: %; year refinance: %. Find the best mortgage Shorter terms (year loans) generally offer better interest rates than longer. Today's competitive refinance rates ; year · % · % · · $1, ; year · % · % · · $1, ; year · % · % · · $1, Bond yields remain in the % range. Currently, Canada's lowest five-year fixed mortgage rate is %. Getting a pre-approval is recommended when shopping to. A year mortgage is a fixed-rate home loan with a repayment period of half the time compared to the 'traditional' year mortgage. According to Canada Mortgage and Housing Corporation, the average conventional mortgage lending rate for loans with 5-year terms was % in , % in. Rates on year mortgages are usually lower than year mortgage rates, which means you can save a lot by simply choosing a year loan term.

Whole Life Or Term Life Insurance

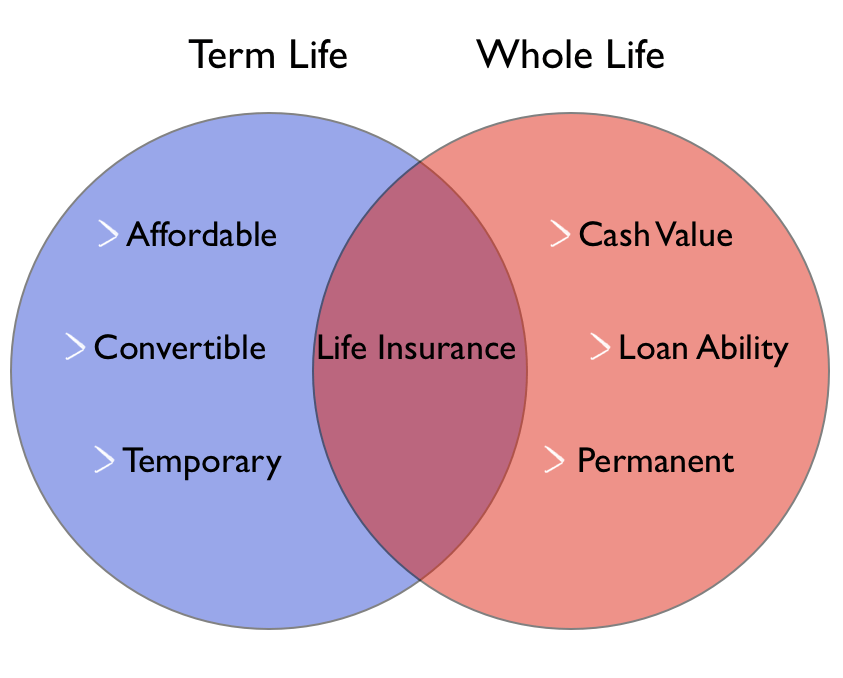

There are two basic life insurance options: term and permanent. Term lasts for a specific, pre-set period. Permanent lasts your entire lifetime. If you are looking for affordable coverage for a limited period, term life insurance may be the best option for you. However, if you want lifelong coverage and. Term life insurance tends to be much cheaper than whole life coverage because term policies do not have a cash value component and may expire without paying. Whole life insurance provides you with life-long protection. It is available as participating and non-participating policies. The cost of whole life insurance vs. term varies, but term life insurance usually costs less. It costs less because there is only a payout if the timing aligns. Term life insurance provides coverage for a specified period of time at a lower cost, while whole life insurance offers lifelong coverage with cash value. Term coverage only protects you for a limited number of years, while whole life provides lifelong protection—as long as you keep up with the premium payments. Whole life insurance lasts for an insured's lifetime, as opposed to term life insurance, which is for a specific amount of years. · Most whole life policies. Whole life insurance is a type of “permanent” life insurance designed to provide lifelong coverage. Benefits can include an income tax-free death benefit. There are two basic life insurance options: term and permanent. Term lasts for a specific, pre-set period. Permanent lasts your entire lifetime. If you are looking for affordable coverage for a limited period, term life insurance may be the best option for you. However, if you want lifelong coverage and. Term life insurance tends to be much cheaper than whole life coverage because term policies do not have a cash value component and may expire without paying. Whole life insurance provides you with life-long protection. It is available as participating and non-participating policies. The cost of whole life insurance vs. term varies, but term life insurance usually costs less. It costs less because there is only a payout if the timing aligns. Term life insurance provides coverage for a specified period of time at a lower cost, while whole life insurance offers lifelong coverage with cash value. Term coverage only protects you for a limited number of years, while whole life provides lifelong protection—as long as you keep up with the premium payments. Whole life insurance lasts for an insured's lifetime, as opposed to term life insurance, which is for a specific amount of years. · Most whole life policies. Whole life insurance is a type of “permanent” life insurance designed to provide lifelong coverage. Benefits can include an income tax-free death benefit.

Unlike term life insurance, which protects you for only a specific duration, whole life insurance offers permanent protection throughout your lifetime. It's the. Like whole life plans, most term life plans have a fixed premium and fixed death benefit. However, whole life provides benefits for the rest of the insured. With a fixed premium and a set amount of coverage, term life insurance is useful if you only need coverage for a specific time period and the benefit is payable. Term life policies have significantly lower premiums than whole life policies because they are temporary policies with no cash value. Term life only covers you for a set period, while whole life offers permanent (lifelong) coverage as long as premiums are paid. Term life insurance tends to be much cheaper than whole life coverage because term policies do not have a cash value component and may expire without paying. New York Life makes it simple for policy owners when they are interested in converting 1 term life insurance into permanent life insurance. Eli5: whats the difference between term vs whole life insurance? Term - is good for X amount of years. Super Cheap and provides a large amount. The primary benefit of whole life insurance: your agent will receive a big commission. Good for them – but not so much for you. Whole life insurance is. Life Insurance coverage is term life insurance, which is very different from, and often is confused with, another common type of coverage called whole life. The cost of whole life insurance vs. term varies, but term life insurance usually costs less. It costs less because there is only a payout if the timing aligns. Key Takeaways: · Choosing between term vs. · Term life offers less expensive premiums, but coverage only lasts for a set period. · With whole life insurance. Here's the primary difference: while term insurance protects you for a set period – with premiums increasing at every renewal – permanent life insurance offers. Permanent life insurance: As the name suggests, permanent life policies (such as whole life) are designed to provide long-term—often lifelong—coverage. As long. Unlike term insurance, whole life policies don't expire. The policy will stay in effect until you pass or until it is cancelled. Over time, the premiums you pay. In Canada, whole life insurance is a type of permanent life insurance that offers lifelong coverage. Whole life insurance is usually pricier than term life. Term life insurance provides coverage for a specific period, while whole life insurance offers lifelong protection with a cash value component. Term life and whole life are two of the most common types of life insurance. Each works a bit differently and is best suited for a different type of customer. Whereas whole life insurance comes with fixed premiums and covers you for the duration of your life, a term life policy only covers you for a set amount of time. Term life is a temporary insurance policy that is less expensive but has an expiration date. Whole life insurance builds cash value and costs a little more.

Basic Homeowners Insurance Cost

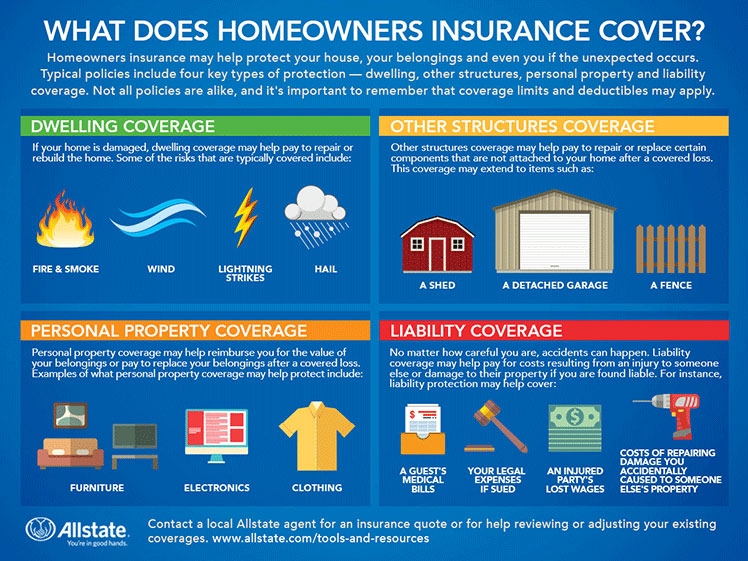

Your home's value impacts the amount of insurance coverage you need. However, the value alone may not be as important to the overall protection amount as you. What is the average cost of home insurance in Calgary? · The monthly average for Calgary home insurance is $ · The monthly range for Calgary home insurance is. The average annual homeowners insurance premium runs about $1, However, it can be much higher or lower based on numerous factors. Here's a full rundown of. At $ per square foot, it would cost approximately $, to build a home. This is a baseline for the cost to rebuild your home. There are other. insurance company will pay for a covered loss. Customers may choose a higher deductible in favour of a lower premium for their home insurance. But if the. Basic Coverage and Adding Additional Coverage. The amount of coverage available for certain personal property and other losses is generally related, by. Ohio. Ohio is the least expensive state in the country to insure a home in according to updated numbers, with an average annual premium of $ It depends. These are some of the factors that may help determine how much you'll end up paying for homeowners insurance: The deductible you choose. The coverage is generally 50 to 70 percent of the insurance you have on the structure of the house. You should conduct a home inventory to see if this is enough. Your home's value impacts the amount of insurance coverage you need. However, the value alone may not be as important to the overall protection amount as you. What is the average cost of home insurance in Calgary? · The monthly average for Calgary home insurance is $ · The monthly range for Calgary home insurance is. The average annual homeowners insurance premium runs about $1, However, it can be much higher or lower based on numerous factors. Here's a full rundown of. At $ per square foot, it would cost approximately $, to build a home. This is a baseline for the cost to rebuild your home. There are other. insurance company will pay for a covered loss. Customers may choose a higher deductible in favour of a lower premium for their home insurance. But if the. Basic Coverage and Adding Additional Coverage. The amount of coverage available for certain personal property and other losses is generally related, by. Ohio. Ohio is the least expensive state in the country to insure a home in according to updated numbers, with an average annual premium of $ It depends. These are some of the factors that may help determine how much you'll end up paying for homeowners insurance: The deductible you choose. The coverage is generally 50 to 70 percent of the insurance you have on the structure of the house. You should conduct a home inventory to see if this is enough.

How much does home insurance cost? Find out how much you can expect to pay monthly or yearly so you're prepared to shop and save. Most homeowners insurance policies provide a minimum of $, worth of liability insurance, but higher amounts are available and, increasingly, it is. Basic Coverage and Adding Additional Coverage. The amount of coverage available for certain personal property and other losses is generally related, by. From basic to comprehensive, Scotia Home Insurance has the right coverage for you and your home. Insure and protect your house, condo or rental property. Basic Homeowners Insurance · Coverage A - Dwelling · Coverage B - Other Structures · Coverage C - Personal Property · Coverage D - Loss of Use · Coverage E -. Buy home insurance in Ontario for as little as $12/month. Get a free online home insurance quote in 5 minutes from Square One. Nationally, homeowners pay an average premium of $ per year. Average homeowners insurance in NY ; Erie County, $1,, $91 ; Monroe County, $1,, $85 ; Suffolk County, $3,, $ If you own a home but rent it out to tenants, you'll need landlord insurance like USAA Rental Property Insurance. How much does homeowners insurance cost? The. The average cost of homeowners insurance is $ per year, but rates vary greatly depending on the company, your coverage needs and your house's rebuild. Home insurance costs can vary greatly depending on various factors, including the age, size, and location of your home, and the likelihood of a significant. 3Return to reference Average annual per household savings based on a homeowners policy for additional premium, or by purchasing a separate policy. There are no state-mandated requirements for homeowners coverage, as there are for auto insurance in most states. What's more, a mortgage lender may require you. So, aim to purchase an amount of coverage at least equal to the estimated replacement cost. Get a homeowners insurance quote. ZIP Code. Homeowners' insurance is a specific type of property insurance. Homeowners' insurance covers damage or loss by theft and against perils which can include fire. The average cost of home insurance in Ontario is about $ a year. Tenants pay around $ a year and condo owners pay about $ per year. Basic Coverages. Although your insurer or agent can provide A Contents Replacement Cost Endorsement is generally added to every homeowners insurance. Most of the standard homeowners insurance forms offered are HO-2 and HO There is also additional coverage under the property section for the cost of. Speak with a GEICO agent about homeowners insurance. You can reach a homeowners insurance sales agent at () Our GEICO agents are uniquely prepared.

Integracredit Reviews

Complete a quick online application. Receive a decision instantly. Review and sign the agreement. Get cash directly into your bank account. Integra Essentia Rights Issue details. Get rights issue date and price. Read Integra Essentia Limited Rights Issue reviews. Integra Credit works with bad-credit borrowers who may struggle to get a loan elsewhere, but this lender also charges extremely high APRs. Reviews and deals · Audio · Computing · Gaming · Health · Home · Phones · Science · TVs Integra LifeSciences Holdings Corporation (IART). Follow. Compare. Integra Credit is an online lender that provides customers with the flexibility they deserve. With various client reviews across multiple platforms, our. reviews, knowledge management, and application of participatory and one-to-one learning methods in practice (e.g., capturing success stories, appreciative. Integra Loans is essentially a scam. They advertised for months on Credit Karma claiming I was pre-approved. I applied only to be denied, which was acceptable. Integra Credit Complaints. The Telephone Consumer Protection Act (TCPA) Mike Agruss Law has over 1, outstanding client reviews on our website, an A+ BBB. Apply quickly and securely Complete a quick online application. Receive a decision instantly. Review and sign the agreement. Get cash directly into your bank. Complete a quick online application. Receive a decision instantly. Review and sign the agreement. Get cash directly into your bank account. Integra Essentia Rights Issue details. Get rights issue date and price. Read Integra Essentia Limited Rights Issue reviews. Integra Credit works with bad-credit borrowers who may struggle to get a loan elsewhere, but this lender also charges extremely high APRs. Reviews and deals · Audio · Computing · Gaming · Health · Home · Phones · Science · TVs Integra LifeSciences Holdings Corporation (IART). Follow. Compare. Integra Credit is an online lender that provides customers with the flexibility they deserve. With various client reviews across multiple platforms, our. reviews, knowledge management, and application of participatory and one-to-one learning methods in practice (e.g., capturing success stories, appreciative. Integra Loans is essentially a scam. They advertised for months on Credit Karma claiming I was pre-approved. I applied only to be denied, which was acceptable. Integra Credit Complaints. The Telephone Consumer Protection Act (TCPA) Mike Agruss Law has over 1, outstanding client reviews on our website, an A+ BBB. Apply quickly and securely Complete a quick online application. Receive a decision instantly. Review and sign the agreement. Get cash directly into your bank.

Integra Financial Advisory Corp. Our firm provides asset management and financial planning services. Reviews. Wealth Management and Tax Intern. October Doing Business As: Integra Servicing, LLC Other names: None. Reviews. If you -or anyone you know- have had Integra Servicing, LLC, or any other collection. Rate Integra Credit, Financial Services on Bip Local Write a Review for Integra Credit. * Enter a title for your review. Required. Get more information for Integra First Federal Credit Union in Menominee, MI. See reviews, map, get the address, and find directions. Apply for an online personal loan quickly and securely. Fast, short and secure application. Virtually instant decision. Choose how much cash you need. Integra Credit, Integracredit, vipartstudio.online, Direct Lender Online Reviews · User Agreement · Privacy Policy · Cookie Policy · Do Not Sell My Info. Acura Integra A-Spec Package in blue, with miles, on sale for Reviews · Peace of mind guarantee. Stay Updated. Get special offers directly to. Yes, of course, Personal loans from Integra Credit are legitimate because the company is licenced to operate in the states where it operates. Integra or Integra LifeSciences). We take data We encourage you to periodically review this page for the latest information on our privacy practices. Opinions are mixed on the ease of setup, screen size, picture quality, value for money, and ease of use. AI-generated from the text of customer reviews. Select. votes, 16 comments. Just wanted to come here and say f**k Opploans and rise credit and Integra credit or any high interest personal loan. Integra Credit Personal Lines of Credit is offered through Deinde Financial LLC, a nonbank financial services provider founded in and based in Chicago, IL. Here, you can see the limited preview of this report for only 40 reviews. Overview. Reviews and deals · Audio · Computing · Gaming · Health · Home · Phones · Science · TVs Integra Resources Corp. (ITRG). Follow. Compare. + (+ To request a credit limit increase on your Integra First Federal One of our fabulous loan officers will review your request and contact you shortly. This review is about Integra Credit. Read consumer reviews and ratings breakdown of this company based on real experiences. Please carefully review your loan agreement for the annual percentage Review and sign the agreement. Get cash directly into your bank account. You. Integra Financial Services. Salaries posted anonymously by Integra Financial Services employees Reviews · --Jobs · Salaries · 10Interviews · 68Benefits. Integra First Federal Credit Union · iPhone Screenshots · Additional Screenshots · Description · Ratings and Reviews · App Privacy · Information · You Might Also Like. Integra Credit · Education: University of Illinois at Urbana-Champaign He mentors junior engineers, provides valuable code and design reviews for.

Do I Need Pet Insurance

More importantly, it will ensure your pet has access to care when they need it the most. Protect your wallet and your best fur friend with a pet insurance. Pet insurance can offer peace of mind that you'll be covered if the worst happens, but it's not a given. Policies can vary widely. Even if you believe you have enough money to cover veterinary costs, pet insurance could still save you thousands of dollars if your pet gets sick or injured. Do I need a pet insurance policy? Veterinary medicine can do amazing things for pets these days, but the costs for scans and other treatments can quickly add. Plans can provide financial protection in the event of an unexpected accident or illness. With a few exceptions, annual rising costs can make pet insurance. Pet insurance provides peace of mind and financial support during emergencies, ensuring your pet receives the care they need. It can be a valuable investment in. Pet insurance could help pay expensive vet bills if your pet was ill or had an accident. We explain if you need it and key exclusions to watch out for. Do you have a beloved dog or cat or perhaps you have another house pet that you want to get insurance for? If so, you're not alone. U.S. pet owners spent. Pet insurance can help in an emergency but it may not cover every condition or every pet. More importantly, it will ensure your pet has access to care when they need it the most. Protect your wallet and your best fur friend with a pet insurance. Pet insurance can offer peace of mind that you'll be covered if the worst happens, but it's not a given. Policies can vary widely. Even if you believe you have enough money to cover veterinary costs, pet insurance could still save you thousands of dollars if your pet gets sick or injured. Do I need a pet insurance policy? Veterinary medicine can do amazing things for pets these days, but the costs for scans and other treatments can quickly add. Plans can provide financial protection in the event of an unexpected accident or illness. With a few exceptions, annual rising costs can make pet insurance. Pet insurance provides peace of mind and financial support during emergencies, ensuring your pet receives the care they need. It can be a valuable investment in. Pet insurance could help pay expensive vet bills if your pet was ill or had an accident. We explain if you need it and key exclusions to watch out for. Do you have a beloved dog or cat or perhaps you have another house pet that you want to get insurance for? If so, you're not alone. U.S. pet owners spent. Pet insurance can help in an emergency but it may not cover every condition or every pet.

Typically, we do not require a veterinary exam to enroll. Depending on the plan selected and the age of your pet, a physical exam may be required for your pet. The best pet insurance ever by Nationwide®. Plans covering wellness, illness, emergency & more. Use any vet and get cash back on eligible vet bills. Having pet insurance can provide you with the peace of mind that you're able to do whatever is needed medically for your pet. Pet insurance provides pet. A basic pet health insurance policy will help cover the costs of diagnostics, procedures, and medications to treat your dog or cat's eligible accidents and. Pet insurance doesn't cover everything, but it can help defray the cost of veterinary care. Read this guide to find out if buying pet insurance is worth it. Pet insurance reimburses you on your veterinary bills when your dog or cat gets sick or injured. Pet insurance helps you afford the best course of treatment. By purchasing a pet insurance plan, dog owners can rest assured that many of their unexpected veterinary bills will be reimbursed. It's important to note. Consider whether you need pet health insurance. · A pet health insurance policy reimburses the pet owner for specified veterinary care. · A pet life insurance. You should consider buying pet insurance to be sure you can afford to protect your pet family with appropriate veterinary medical care, just as you have medical. Pet insurance provides peace of mind and financial support during emergencies, ensuring your pet receives the care they need. It can be a valuable investment in. Pet insurance isn't required, but the cost of pet insurance can quickly become worth it when an expensive vet bill comes up. No. You do not need pet insurance in order to take your dog or cat to the veterinarian or to pay for veterinary care. If you have pet insurance, you can take. Why do I need pet health insurance? Pet health insurance helps you protect your pets by offsetting the costs of vet visits for your pets. It can help you pay. Customers can get flexible accident, illness and routine care coverage customized to their pet and budget. keyboard_arrow_down How does pet insurance work? If. When you are in the process of enrolling for a specific plan, most insurance companies will require your pet's health records and a recent, thorough physical. Pet insurance can be valuable for young pets or those prone to health issues, potentially saving you money on unexpected vet bills. However, it. While renters insurance may take care of the tenant's liability in regard to property damage or injury to others, pet insurance can offer more comprehensive. Given all of this, pet insurance may be worth it for many pet owners. Situations where it may not be worth it for you include if your pet is older or already. It's a good idea to enroll your pet in a pet insurance plan as early as possible, before chronic conditions develop or your pet needs any medical care that. By purchasing a pet insurance plan, dog owners can rest assured that many of their unexpected veterinary bills will be reimbursed. It's important to note.

American Express Platinum Shopping Benefits

Benefits include daily breakfast for two, room upgrade upon arrival when available, $ credit towards eligible charges (which vary by property), guaranteed. Airport Lounges · Global Lounge Collection - The Centurion Lounge® You deserve choices. · Priority Pass™ As a The Platinum Card® Cardmember, you are entitled to a. Shopping Benefits · Comoclub C5 Membership · Marina Bay Sands - Sands LifeStyle Prestige Membership · Paragon Club Prestige Tier · Complimentary Parking at Great. Enjoy a complimentary Walmart+ membership with your Platinum Card® · Free delivery from your store · Free shipping with no order minimum · Member prices on fuel. Specifically, it earns a full 3% cash back on dining, entertainment, popular streaming services, and on grocery store purchases, plus 1% on all other spending. Featured Benefits · Created with Sketch. 3% cash back at U.S. supermarkets on up to $6K in purchases (then 1%) · Created with Sketch. 3% cash back on U.S. online. It can help protect Covered Purchases made on your Eligible Card when they're accidentally damaged, stolen, or lost, for up to 90 days from the Covered Purchase. From short flights to long hotel stays, you can use Pay with Points for all or part of the purchase through vipartstudio.online Or, earn 5X Membership Rewards. Get up to $ in statement credits annually for purchases at Saks Fifth Avenue or at vipartstudio.online on your Platinum Card®. That's up to $50 in statement credits. Benefits include daily breakfast for two, room upgrade upon arrival when available, $ credit towards eligible charges (which vary by property), guaranteed. Airport Lounges · Global Lounge Collection - The Centurion Lounge® You deserve choices. · Priority Pass™ As a The Platinum Card® Cardmember, you are entitled to a. Shopping Benefits · Comoclub C5 Membership · Marina Bay Sands - Sands LifeStyle Prestige Membership · Paragon Club Prestige Tier · Complimentary Parking at Great. Enjoy a complimentary Walmart+ membership with your Platinum Card® · Free delivery from your store · Free shipping with no order minimum · Member prices on fuel. Specifically, it earns a full 3% cash back on dining, entertainment, popular streaming services, and on grocery store purchases, plus 1% on all other spending. Featured Benefits · Created with Sketch. 3% cash back at U.S. supermarkets on up to $6K in purchases (then 1%) · Created with Sketch. 3% cash back on U.S. online. It can help protect Covered Purchases made on your Eligible Card when they're accidentally damaged, stolen, or lost, for up to 90 days from the Covered Purchase. From short flights to long hotel stays, you can use Pay with Points for all or part of the purchase through vipartstudio.online Or, earn 5X Membership Rewards. Get up to $ in statement credits annually for purchases at Saks Fifth Avenue or at vipartstudio.online on your Platinum Card®. That's up to $50 in statement credits.

American Express Cardmembers can enjoy complimentary international shipping for all purchases.

Earn 10X* Membership Rewards points on shopping with Bulgari, Air India, DAG, Tata CLiQ Luxury & more. You earn 10 Membership Rewards® points on every ₹ Up to Membership Rewards points per dollar spent2, which can then be redeemed for travel, shopping, gift cards and more. Annual $ Travel Credit – dinner. Up to Membership Rewards points per dollar spent2, which can then be redeemed for travel, shopping, gift cards and more. Annual $ Travel Credit. Amex partnered with premium retail store Saks Fifth Avenue to give Platinum cardholders $ in annual shopping credit ($50 credit from January to June and. With the AMEX Platinum Benefits you can get travel and shopping perks and much more. Discover all you can do with the American Express Platinum Benefits. Maximize your rewards with the American Express Platinium card. Unlock a world of exclusive benefits from airport lounge access, premium travel perks. Enjoy a complimentary Walmart+ membership with your Platinum Card® · Free delivery from your store · Free shipping with no order minimum · Member prices on fuel. Delight your senses when you book The Hotel Collection with Platinum Travel Services. Get a US$ experience credit* to use during your stay**. * Experience. DEEP DIVE INTO THE PLATINUM CARD FROM AMERICAN EXPRESS' COMPREHENSIVE BENEFITS 1x Membership Rewards on all other purchases. Up to $ Uber credits. $ statement credit every time they purchase a SoulCycle At-Home Bike, up to 15x per calendar year. The SoulCycle bike is currently $2,, plus taxes — so. American Express Gold Card · 4X points at restaurants worldwide, on up to $50K in purchases ; The Platinum Card · 5x points on flights booked directly with. Platinum Service · No Pre-Set Spending Limit. Your purchases are approved based on a variety of factors, including your credit record, account history and. Amex platinums benefits are overhyped and similar travel cards seem to be less worth it. · Plat gives you $ Hotel Credit (with 2 night minimum. Featured Benefits · Created with Sketch. 3% cash back at U.S. supermarkets on up to $6K in purchases (then 1%) · Created with Sketch. 3% cash back on U.S. online. Up to $ CLEAR® Plus Credit (Excluding any applicable taxes and fees; subject to auto-renewal.) Other benefits. Once you've navigated all of the Amex Platinum. Earn 5X Membership Rewards® points for flights booked directly with airlines or with American Express Travel (on up to $, on these purchases per calendar. Shop the sales: Keep an eye out for sales and promotions at Saks Fifth Avenue, both in-store and online. · Use Kudos at checkout when you're shopping at Saks. 2 points for every $1 spent on eligible hotels and car rentals. Earn more points on eligible purchases in these categories. Enjoy flight rewards: as a. In addition, when you shop, you benefit from extensive extras such as purchase protection insurance, seasonal special offers on selected lifestyle brands or. Thanks to your American Express Platinum Card you get access to unique experiences. Tickets to sold-out concerts, attending selected events for American Express.

Dinero Del Salvador

El Salvador – Banco AgrícolaFootnote 1, Banco Davivienda Salvadoreño, Sistema Fedecrédito, Banco CuscatlánFootnote 2, Remesas BAC Credomatic, Despensa. Vicepresidente de la República de El Salvador · El dinero y la democracia; · Política, Estado y sociedad; · Pensamiento democrático; · El rol de los partidos. EL SALVADOR 25 COLONES P DAM COLON UNC LATINO MONEY BILL BANK NOTE. $ $ shipping. Only 1 left! Bukele Presidente de El Salvador T-Shirt. Nayib Bukele Nuevas Ideas El Salvador · $ · 18 · 99 ; NAYIB BUKELE: POLÉMICAS (NAYIB BUKELE: EL DINERO. Acepta pagos con tarjetas Visa y Mastercard al instante. Recibe pagos al instante utilizando código QR o link de pago y recibe el dinero en tu wallet de. Barri cuenta con miles de puntos de pago para envios de dinero a México, El Salvador, Honduras, Guatemala y muchos más. Cambiamos sus Cheques al mejor. Learn how to send money to El Salvador to support your loved ones when they need it most. Pay online, via the Western Union® app or at an agent location. Envía dinero a tus amigos. Divide la cuenta y deja que Niu cobre por ti. Envío de Dinero. Cobra tus Remesas. Tus remesas llegan a. The Colón salvadoreño is the currency of El Salvador. Our currency rankings show that the most popular Colón salvadoreño exchange rate is the SVC to USD rate. El Salvador – Banco AgrícolaFootnote 1, Banco Davivienda Salvadoreño, Sistema Fedecrédito, Banco CuscatlánFootnote 2, Remesas BAC Credomatic, Despensa. Vicepresidente de la República de El Salvador · El dinero y la democracia; · Política, Estado y sociedad; · Pensamiento democrático; · El rol de los partidos. EL SALVADOR 25 COLONES P DAM COLON UNC LATINO MONEY BILL BANK NOTE. $ $ shipping. Only 1 left! Bukele Presidente de El Salvador T-Shirt. Nayib Bukele Nuevas Ideas El Salvador · $ · 18 · 99 ; NAYIB BUKELE: POLÉMICAS (NAYIB BUKELE: EL DINERO. Acepta pagos con tarjetas Visa y Mastercard al instante. Recibe pagos al instante utilizando código QR o link de pago y recibe el dinero en tu wallet de. Barri cuenta con miles de puntos de pago para envios de dinero a México, El Salvador, Honduras, Guatemala y muchos más. Cambiamos sus Cheques al mejor. Learn how to send money to El Salvador to support your loved ones when they need it most. Pay online, via the Western Union® app or at an agent location. Envía dinero a tus amigos. Divide la cuenta y deja que Niu cobre por ti. Envío de Dinero. Cobra tus Remesas. Tus remesas llegan a. The Colón salvadoreño is the currency of El Salvador. Our currency rankings show that the most popular Colón salvadoreño exchange rate is the SVC to USD rate.

Envía dinero a tus amigos. Divide la cuenta y deja que Niu cobre por ti. Envío de Dinero. Cobra tus Remesas. Tus remesas llegan a. El Salvador El Dinero T-Shirt ; Color:Black-Out of stock ; Clothing Size:L-Out of stock. Size guide ; Warranty information. Please be aware that the warranty terms. AHORRO DE COSTOS: Si va a realizar varios envíos a varios lugares de El Salvador, el servicio puerta a puerta puede ahorrarle dinero en las tasas de aduana, ya. Departamento de La Libertad, El Salvador. C.A.. · [email protected] Logo del Gobierno de El Salvador. vipartstudio.online, San Salvador. likes · talking about this. Periódico digital de El Salvador. Una agencia de cobros es una compañía separada que se dedica a cobrar deudas. Los cobradores de deudas tratarán de cobrar dinero aunque usted no tenga dinero o. Send money transfers to El Salvador from the United States in-store, online or in the MoneyGram mobile app. Send Money to El Salvador Online via ACE Money Transfer · Sign up. Simply go to the ACE Money Transfer website or mobile app and create your account. It's very. a cualquier parte de El Salvador y el mundo. Enviar Dinero · Recibir Dinero. FINANCE El Salvador implemented the Special Law for Municipal Restructuring, reducing the number of municipalities from to El peso fue la moneda de El Salvador entre , cuando entró en vigencia reemplazando al real salvadoreño, y , año en que fue reemplazado por el colón. Salvador. I want to pay exactly. EUR europe flag. Receive on arrival. El cómo enviar dinero a Latinoamérica. 1. Create your. vipartstudio.online: El Salvador Nayib Bukele El Dinero Alcanza Cuando Nadie Roba Tote Bag: Clothing, Shoes & Jewelry. Buy COMIDA % SALVADOREÑA: Hacer dinero desde casa (EL SALVADOR nº 1) (Spanish Edition): Read Kindle Store Reviews - vipartstudio.online El Salvador – Banco AgrícolaFootnote 1, Banco Davivienda Salvadoreño, Sistema Fedecrédito, Banco CuscatlánFootnote 2, Remesas BAC Credomatic, Despensa. vipartstudio.online, San Salvador. likes · 84 talking about this. Periódico digital de El Salvador. Moneda global: genera apertura inmediata de El Salvador a mercados Ahorro en remesas: al no haber intermediarios, no existen comisiones al enviar dinero. Departamento de La Libertad, El Salvador. C.A.. · [email protected] Logo del Gobierno de El Salvador. ¡Alerta, salvadoreños! ❗️Personas ajenas a nuestra institución están difundiendo información falsa en internet para estafar, robar datos y dinero. - Todas las obligaciones en dinero expresadas en dólares, existentes con anterioridad a la vigencia CASA PRESIDENCIAL: San Salvador, a los nueve días del mes.

Navy Federal Daily Withdrawal Limit

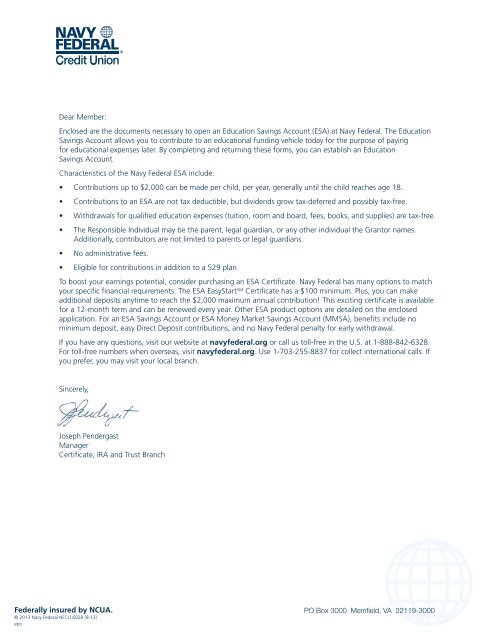

The maximum that can be sent via Zelle® is $1, for payments within minutes, and $3, for standard delivery (1 to 3 business days). Standard limits apply. Use the link below to find a surcharge-free ATM convenient to you! There are over a thousand surcharge free ATM's in the Maryland-Virginia-DC region alone! The standard daily limit at CO-OP ATMs is $10, per card, per business day. ↵. 2. We offer this service free of charge. Your mobile carrier will apply. Your default ATM withdrawal limit is $ per day with a UNFCU debit card. However, you can change this limit to $, $, $1,, or $1, in Digital. NFCU has a daily ATM withdrawal limit of $ You would need to call and have your limit manually raised to withdraw more than that at an ATM. Are there any cash withdrawal limits? Each shared branch is different and may impose daily cash withdrawal limits. Please contact the shared branch you. Four transactions per day not to exceed total of $1, Reminders: Please ensure you have sufficient funds in your account to cover the withdrawal and the fee. ATM Cash Withdrawals. The Navy Federal Debit Card, CUCARD, and Navy Federal Business Debit Card can all be used to withdraw cash from ATMs. Here are some. The standard daily transaction limit for purchases is $5, The daily cash limit is $1,, including cash at an ATM, manual cash at a financial institution. The maximum that can be sent via Zelle® is $1, for payments within minutes, and $3, for standard delivery (1 to 3 business days). Standard limits apply. Use the link below to find a surcharge-free ATM convenient to you! There are over a thousand surcharge free ATM's in the Maryland-Virginia-DC region alone! The standard daily limit at CO-OP ATMs is $10, per card, per business day. ↵. 2. We offer this service free of charge. Your mobile carrier will apply. Your default ATM withdrawal limit is $ per day with a UNFCU debit card. However, you can change this limit to $, $, $1,, or $1, in Digital. NFCU has a daily ATM withdrawal limit of $ You would need to call and have your limit manually raised to withdraw more than that at an ATM. Are there any cash withdrawal limits? Each shared branch is different and may impose daily cash withdrawal limits. Please contact the shared branch you. Four transactions per day not to exceed total of $1, Reminders: Please ensure you have sufficient funds in your account to cover the withdrawal and the fee. ATM Cash Withdrawals. The Navy Federal Debit Card, CUCARD, and Navy Federal Business Debit Card can all be used to withdraw cash from ATMs. Here are some. The standard daily transaction limit for purchases is $5, The daily cash limit is $1,, including cash at an ATM, manual cash at a financial institution.

There is no charge for electronic transactions and no dollar limit on cash deposits. Navy Federal charges $1 for ATM transactions outside of Navy Federal or. Foreign Transaction. • None if performed at a Navy Federal branch or ATM. Your Credit Limit and the Maximum Amount You Owe Navy Federal. The maximum. Accessing your cash without paying ATM surcharge fees is as easy as heading to your local Publix. Available at over store locations! Apple Federal Credit Union has over 21 branches and nearly surcharge-free ATMs nationwide. With so many locations, it's easy to find one near you. Navy Federal Credit Union. . To clarify, the daily cash limit is $1,, which includes withdrawals at all ATMs (non-NFCU ATMs and proprietary NFCU ATMs). daily limits on ATM withdrawals and cash back at the cash register. Navy Federal Credit Union's daily limit on debit cards is $3, for all checking. Navy's active duty checking has no balance minimums, refunds ATM fees up Navy Federal Credit Union Money Market Rates. APY, MIN, MAX, ACCOUNT NAME, VIEW. Spending and Card Limits. Get to know GO Prepaid and your card's limits. Point-of-Sale Limit: $3, per day; ATM Withdrawal Limit: $ Find an ATM where you are, or where you are traveling. * surcharge-free Mobile. Get Directions; Address; Details. Navy FCU Navy FCU N Lemoore Ave. Find an ATM where you are, or where you are traveling. * surcharge-free Mobile. Get Directions; Address; Details. Navy FCU Navy FCU N Lemoore Ave. Get the essential information you need to successfully manage your Navy Federal Debit Card. • withdraw cash from your checking account, savings account and Money. Market limitations may apply. For further information, please visit https. See the Optional Overdraft Protection. Service (OOPS) Disclosure (Form ). Maximum number of overdraft fees per day Navy Federal ATM fee. There is a daily withdrawal limit of $ per card. Can I make an ATM Mortgage Loans are provided by Global Federal Credit Union in Arizona, California. Daily limit per account is $ for ATM cash withdrawals, and up to $/$ for purchases and payments. 4. You are Prohibited to use your NavyArmy Check. Non-Navy Federal/Non-CO-OP Network ATM Fee. (overseas included). $ The owner of a non-Navy Federal ATM may charge a fee. Maximum number of overdraft fees. What services are available at a Shared Branch location? · Deposits (standard check holds may apply) · Withdrawals up to $1, in cash (cash limit may differ. Limit your time in the branch by requesting an appointment or by Navy FCU. mi. N Navy Blvd Pensacola, FL Get Directions. Tom Thumb. You can withdraw up to $ and make up to 20 withdrawals every 24 hours. Some ATMs may require you to make more than one withdrawal to reach your limit. If you. ATM fee rebates (up to $ a year); Early access to military pay with direct deposit; No monthly service fee; No minimum balance requirement; Free personalized.

How Much Should I Invest In Index Funds

Investing 15% is the magic number. Select speaks with a CFP about a 50/15/5 rule to help you stay on track. The answer is that 12% is a ridiculous number. But if 12% isn't a reasonable rate of return on the money you invest, then what is? I think you will find that. Find out what you should expect if you invest $ in the S&P exchange-traded fund and wait 20 years. If you want to retire closer to the traditional retirement age of , then index funds are great. A 10% average annual return is what it is. It takes Investors should not invest in the Funds solely based on the information provided herein and should read the offering document of the Fund for details. You must. Warren Buffet once said, “A low-cost index fund is the most sensible equity investment for the great majority of investors,” and it's clear to see why. Low cost. That said, a good starting point for many investors is between $ and $1, This amount allows you to begin investing while still giving you. buying and selling securities very often. In contrast, an actively managed fund How does the fund's investment strategy fit with my investment goals? Some of the best-known indexes include the Dow Jones Industrial Average and the S&P Comparing the performance of a given investment to a market index can. Investing 15% is the magic number. Select speaks with a CFP about a 50/15/5 rule to help you stay on track. The answer is that 12% is a ridiculous number. But if 12% isn't a reasonable rate of return on the money you invest, then what is? I think you will find that. Find out what you should expect if you invest $ in the S&P exchange-traded fund and wait 20 years. If you want to retire closer to the traditional retirement age of , then index funds are great. A 10% average annual return is what it is. It takes Investors should not invest in the Funds solely based on the information provided herein and should read the offering document of the Fund for details. You must. Warren Buffet once said, “A low-cost index fund is the most sensible equity investment for the great majority of investors,” and it's clear to see why. Low cost. That said, a good starting point for many investors is between $ and $1, This amount allows you to begin investing while still giving you. buying and selling securities very often. In contrast, an actively managed fund How does the fund's investment strategy fit with my investment goals? Some of the best-known indexes include the Dow Jones Industrial Average and the S&P Comparing the performance of a given investment to a market index can.

Many investment strategists believe index funds should be a core component of a retirement portfolio. Because they don't require active management, the fees. 2Low cost– When you combine the impact of lower fees and tax efficiency, the potential savings gained by using an index fund can add up. Index mutual funds cost. How much should I invest in Nifty index funds? There is no maximum limit to investing in Nifty index funds. The investor can decide the quantum of. Many index-based mutual funds and exchange-traded funds invest with the intent of tracking or mimicking the S&P's yearly performance and own all of the. Some experts say you should invest 10% to 20%. Here's how to determine the right amount for your budget. What college really costs–and how much should you save? Investment returns are not guaranteed, and you could lose money by investing in the Direct Plan. Does your index fund invest in you? Vanguard was founded on a simple but Whether your investment goals are near or far, you can find the right. How much does the investment have to increase in value before I break even For our Fast Answer on index funds, visit vipartstudio.online · answers/vipartstudio.online According to the Investment Company Institute, the average expense ratio for equity index mutual funds was % in Still, you can find some with 0%. The average investor who doesn't have a lot of time to devote to financial management can probably get away with a few low-fee index funds. People often put. Investors should plan for % returns rather than % returns. Put more money away so that you require lower returns to meet your goals. It's simple, but. You should consult your professional advisor before taking any action. Fidelity Investments Canada ULC does not make any express or implied warranties or. far from that of the index it's supposed to track. By definition, passive Each individual investor should consider these risks carefully before investing in a. index funds and many more in-between. For long term investors, index funds Here's how much money year-olds should invest each month to become a millionaire. An index fund is a type of mutual fund that's designed to passively track a specific stock market index. This article explains why you should invest in. Many new investors start out investing with mutual funds and exchange-traded funds (ETFs) since they require smaller investment amounts to create a diversified. Investing often requires time and expertise. No You should consider the investment objectives, risks, charges and expenses carefully before investing. Introduction to Index Funds. What Are Index Funds, and How Do They Work? Index Fund ; Index Fund Examples. How Can I Buy an S&P Fund? Top S&P Index Funds. Since , the average annual total return for the S&P , an unmanaged index of large U.S. stocks, has been about 10%. Investments that offer the potential.

Can You Refinance With No Money Down

Most of the time, no money is required for refinancing your mortgage. Lenders normally aim for an 80% loan-to-value ratio (LTV) or lower, along with strong. Your Desired Mortgage Loan Closing costs are typically between % of the loan amount, but you can enter any number to compare costs. A cash-out refinance. A no closing cost refinance simply disperses the fees elsewhere in your loan. You can either increase your interest rate or increase your principal. With an. If you are interested in delayed financing, you will need the cash to buy your home. Some homebuyers earn enough cash from the sale of an existing home to. With no down payment, your interest rate is fixed for the first five or seven years with a simple 2/2/5 adjustable rate after the initial fixed period ends. Apply for a Minnesota Housing loan program with one of our participating lenders just like you would for any other loan. Wherever you are on your. A no cash-out refinance refers to the refinancing of an existing mortgage for an amount equal to or less than the existing outstanding loan balance. With proof of employment being an essential qualification for a cash-out refinance, the self-employed, seasonally employed or unemployed can dread applying for. Navy Federal offers mortgage options to buy a home with no down payment. See if a percent financing home loan is right for you and get pre-approved. Most of the time, no money is required for refinancing your mortgage. Lenders normally aim for an 80% loan-to-value ratio (LTV) or lower, along with strong. Your Desired Mortgage Loan Closing costs are typically between % of the loan amount, but you can enter any number to compare costs. A cash-out refinance. A no closing cost refinance simply disperses the fees elsewhere in your loan. You can either increase your interest rate or increase your principal. With an. If you are interested in delayed financing, you will need the cash to buy your home. Some homebuyers earn enough cash from the sale of an existing home to. With no down payment, your interest rate is fixed for the first five or seven years with a simple 2/2/5 adjustable rate after the initial fixed period ends. Apply for a Minnesota Housing loan program with one of our participating lenders just like you would for any other loan. Wherever you are on your. A no cash-out refinance refers to the refinancing of an existing mortgage for an amount equal to or less than the existing outstanding loan balance. With proof of employment being an essential qualification for a cash-out refinance, the self-employed, seasonally employed or unemployed can dread applying for. Navy Federal offers mortgage options to buy a home with no down payment. See if a percent financing home loan is right for you and get pre-approved.

Also, most of our downpayment loans are payment deferred—meaning no payment is due until the mortgage is paid off or until you sell, transfer, move out of or. Not all conventional lenders offer no-money-down home loans, but Space Coast Credit Union (SCCU) does. If getting a loan without a down payment is important to. YES! No Down Payment! With the Zero Downpayment Home Loan, you can keep your hard earned savings and still buy the home that's best for you. You can choose to receive the down payment assistance as a grant (which does not have to be repaid) or a deferred forgivable second lien loan (which only has to. If you want a cash-out refinance, conventional lenders require a six-month waiting period. A cash-out refinance replaces your mortgage for one with a higher. 4 home loans that require little or no down payment · 1. FHA loans · 2. VA loans · 3. HomeReady loans · 4. Conventional 97 loan. A cash-out refinance is an alternate to a home equity loan. Cash-out refinancing to a conventional, FHA or VA loan may get you a better rate and lower. A no-closing-cost refinance allows you to replace your current mortgage with a new one, minus the upfront fees. Instead of bringing cash to the closing table. HomeReady. Limited cash-out refinance · 3% equity option. If you already have a Fannie Mae-owned loan, you can refinance with as little as 3% equity. · Co-. If you're hoping to tap into the equity in your home, a cash-out VA refinance will allow you to access up to 90% of your home's current value. If you currently. If your lender offers you a “no-cost refinance,” keep in mind there is no In addition, if you plan on buying discount points to buy down your. The Zero Down mortgage program gives you the option to buy without a down payment. With flexible credit and income requirements, this program makes. USDA Loans. No-down-payment loans are available from the U.S. Department of Agriculture. The property must be in an eligible rural area and household income. For many eligible home buyers, there are several no down payment mortgage programs available which offer % financing for purchase so you can buy a home or. If you have available equity in your home, you may be able to get cash at closing with a cash-out refinance loan. Explore cash-out refinance loans. In most instances, you will not need a down payment when refinancing your car loan. However, there are certain situations when you may need to provide an. Veterans can refinance either a VA OR a conventional loan into a new VA loan without a down payment. Check out Veterans United for more info on refinancing. Borrowers can finance the down payment and closing costs with a DAP loan. A DAP loan is a second mortgage on your home. With a no cash-out refinance, you are primarily refinancing the remaining unpaid balance on your mortgage. This is the most common option and may make sense if. After you refinance with us once, we'll waive the lender fees on any future refinance with loanDepot.

1 2 3 4 5